Malvika Misra, 1833453

Christ (Deemed to be University)

About the Blog

The Greece has been in the headlines due to its failing economy and unimaginably large amounts of debt. But the reason as to what has actually happened, the implications of certain steps, and a proper analysis of many issues and aspects of the Greek economy has been made in order to gain a macroeconomic view on the Greek economy. In this assignment, we learn about the behavior of macroeconomic elements such as inflation and unemployment. We also understand, in brief, of the state of other countries and their economies, and compare them with that of Greece.

Introduction to the Greek Economic Crisis

The crisis of the Greek economy started making itself very prominent in the news in the year 2009. The case of the Greek economy is a very peculiar and tragic one, as it has managed to get its economy into a pit from which it cannot recover, at least not for the next few decades. Even to this date, the Greek economy has still not recovered. Let us understand why and how it happened, and apply the theories pertaining to macroeconomics.

Causes: What was and what is

The beginning of the crisis cannot be blamed on only one major event of the time, what we all know as the global financial crisis. Yes, Greece was in particular one of the countries that was affected due to the global financial crisis. But how it really began was in the year 2001, when Greece joined the Eurozone, and adopted the Euro as their currency. This was a period when the labour costs had increased due to a burst of trade volume in the euro zone during that time. Increase in costs of labour led to a trade deficit, when Greece started to consume more than it could produce. Not only this, but when Greece joined the Eurozone in the first place, the economy was weak to begin with. (Greek Boston, 2010)

When Greece joined the Eurozone, its prospects were considered to be good, which is why Greece was backed up by many investors, institutions, and countries. But when the global financial crisis occurred, Greece was hit badly. Not to mention, unemployment increased, and one of the main issues was how the ratio of general government debt and the Gross Domestic Product (GDP) was increasing in such a way that there was a negative growth in the economy. General government debt is calculated as the sum of the following categories: currency and deposits; debt securities, loans; insurance, pensions and standardized guarantee schemes, and other accounts payable. It is a major indicator for the sustainability of government finance. The general government debt of Greece in 2015 was a high 183% of its GDP. (Organisation for Economic Co-operation and Development, 2015)

The phenomena of increasing percentage of general government debt in terms of percentage of its GDP raised many concerns as this issue persisted, because as the data recorded in 2018 states that the general government debt as a percentage of the GDP of Greece was 181.1%, which was the highest among all the countries of the Eurozone.

Unemployment Rate

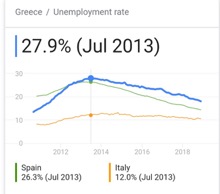

Let us focus on a key factor that determines the health of an economy; the unemployment rate. The unemployment rate of Greece in the month of July, 2013, went up to 27.9%. As we can see in the graph given below, we can see how the unemployment rate slowly starts to increase around the year 2010, and reaches its highest in the year 2013, and slowly starts to decrease. The most recent record of the unemployment rate in Greece in December 2018 is 18%. When the unemployment rate dropped below 20% in the year 2018, it was a huge relief to the Greek economy as the unemployment rate had finally decreased after 3 bailouts that were given to Greece over a period of 7 years, after the Eurozone realized the grave situation Greece had gotten into. (Euractiv, 2018)

Phillips curve

One interesting fact about Greece’s economy is that it adheres to the theory developed by Samuelson and Solow, called the Phillips Curve, named after William Phillips. This concept is interesting as if we see the inflation rate of the Greek economy, the rate of inflation has remained very low. The inflation rate in December 2018 was only 0.10%. While in the same period, the unemployment rate was as high as 18%. According to the Phillips Curve, there is an inverse relationship between inflation and unemployment. Furthermore, to reduce unemployment, the government would have to pump in money and increase its expenditure on the public to increase employment, this in turn increases consumption, the aggregate demand increases, and finally prices increases, which in turn cause an increase in the rate of inflation. But the main issue here is, with huge amounts of public debt, there is no scope for increasing its expenditure in order to decrease unemployment. (StatBureau, 2019)

Analysis of the Crisis

This imbalance of government revenue and expenditure can be explained. There are two macroeconomic policies that are prominent and necessary for an economy to essentially exist. They are the monetary and fiscal policy. In Greece, the monetary policy is controlled by the European Central Bank. Hence, the generation of money is not done according to the Greek economy, but by the European Central Bank, under its common and strict guidelines. But the fiscal policy is under the control of Greece. Which essentially means that the amount of expenditure, i.e. the amount of expenses allotted towards various sectors, and the amount they should invest. This created a major issue as now, Greece doesn’t have the power to generate money in the economy. Not to mention, the European Central Bank cannot print more money to the Greek economy, as they do so, according to the common guidelines established regarding the printing of currency across the Eurozone. There is a flaw in this concept as, though the Euro was made as symbol of unity between the countries of the European continent, it is hardly practical for one currency with the same rules to govern over so many countries. Let us take an example of Germany and Greece. The German economy was and is much stronger than Greece’s. The increase in labour costs when Greece joined the Eurozone, this did not negatively impact Germany, but in Greece, due to increase in labour costs, the employment rate was badly affected, which led to a decrease in disposable income in the economy and the people could barely afford to purchase the necessary commodities to live. This drastically reduced the aggregate demand, which in turn reduced the prices drastically. This eventually led to a very low inflation rate. When we talk about different strengths of economies in the Eurozone, the very graph depicting the unemployment rate of Greece and of Spain and Italy shows the variety. The unemployment rate of Italy is a mere 12%, whereas Spain has an unemployment rate of 26.3% in July 2013. These facts support the irrationality of combining 19 countries and putting them under one currency. (Figure 1) (Eurostat, 2019)

The Three Bailouts

Let us talk about another very important factor of Greece’s recovery, that is, the bailouts. The first bailout that Greece received was from the International Monetary Fund (IMF) and the European Union (EU) on 2 May 2010, for the amount of 110 Billion Euros. The second bailout was given to Greece on 21 February 2012 for 130 billion euros. And finally, the third bailout was approved in August 2015. Each of these bailouts can be called as mega loans that were given to Greece, and obviously with a set of strict conditions and rules that must be followed. One of the most unpopular conditions that Greece had to agree to were Austerity measures, where the pension plans were drastically cut down, taxes increased, and the overall public expenditure were to be drastically reduced, this included that tax evasions needed to be curbed, and an improve in data credibility. This created a lot of agitation amongst the public as the acceptance of this condition created huge discomfort for Greece’s citizens.

Many critics have said that these bailouts are only a way for the other stronger economies, that are a part of the Eurozone, to distance themselves from Greece. After analyzing Greece’s situation, it seems hard for them to come even near to the status of a stable economy, let alone a strong economy. But there has been a gradual improvement in the economy, and if given a few more decades, Greece should eventually get back on its feet. The bailout money given to them is a way to barely stay alive, but it cannot help them properly as the flaw in the economy is its very structure, its debt structure, the size of its businesses and so on. (Council on Foreign Relations, 2018)

Public Expenditure

Another important part of this analysis is what the government does spend on its public. One expenditure that a government makes is Public Unemployment Spending. Public Unemployment Spending is defined as expenditure on cash benefits for people to compensate for unemployment. The public unemployment spending of Greece as of 2017, was only 0.49% of its GDP, as a result of its Austerity measures and attempt to decrease their public spending as they no control on their Monetary Policy. (Organisation for Economic Co-operation and Development, 2017)Let us keep in mind that at this point of time the third bailout agreement that was given to Greece was about to end. Due to the risk of putting the 86 billion Euros program in jeopardy, the Prime Minister Tsipras imposed more taxes and pension reforms, despite the tensions and resistance of the public. (Council on Foreign Relations, 2018)

Conclusion

Greece’s economy is at a very grave and precarious position, as stated before. As we observed, the inflation rate of Greece is extremely low. And according to the Phillips curve, the best solution to remove the high rate of unemployment, is to stimulate and increase the inflation rate. But this is where the main problem lies as people do not have enough money to serve their daily needs. One in every five people in Greece do not have enough money to buy food to meet their basic nutritional needs. Since people don’t have enough money to increased their consumption, demand remains low, and inflation remains to be low. Currently, Greece has exited the third bailout program. It owes the European Union(EU) and the International Monetary Fund (IMF) about 290 billion Euros. To finance this debt, Athens commits to running a budget surplus through 2060, accepts EU financial supervision and imposes additional austerity measures. So, at this point of time, the only thing one every one can say is that eventually, gradually, the economy will heal over time. (Council on Foreign Relations, 2018)

Bibliography

Organisation for Economic Co-operation and Development. (2017). Public Unemployment Spending. Retrieved from OECD web site: https://data.oecd.org/socialexp/public-unemployment-spending.htm

Organisation for Economic Co-operation and Development. (2015). General Government Debt. Retrieved from OECD web site: https://data.oecd.org/gga/general-government-debt.htm

Council on Foreign Relations. (2018). Greece’s Debt. Retrieved from CFR web site: https://www.cfr.org/timeline/greeces-debt-crisis-timeline

StatBureau. (2019). Inflation Rate in Greece. Retrieved from Statbureau web site: https://www.statbureau.org/en/greece/inflation

Eurostat. (2019). Eurostat: Home. Retrieved from Eurostat web site: https://ec.europa.eu/eurostat/web/main

Greek Boston. (2010). How the Greek Economic Crisis Began . Retrieved from Greek Boston web site: https://www.greekboston.com/culture/modern-history/economic-crisis/

Euractiv. (2018). Euro and Finance: Greece’s unemployment falls under 20% after 7 years of bailout. Retrieved from Euractiv: https://www.euractiv.com/section/economy-jobs/news/greeces-unemployment-falls-under-20-after-7-years-of-bailout/

Figure 1. (Eurostat, 2019)

Figure 2. (Eurostat, 2019)